(UPDATE as of July 4th 2020: On Saturday, July 4th, President Trump signed an extension of the small business loan Paycheck Protection Program (PPP) into law, according to the White House. PPP will now remain open to applications through August 8th.)

Many business owners who have received their PPP loan are struggling to ensure all their spending falls within the right parameters in order to receive forgiveness. Last week we broke down those strict guidelines and answered some of your most pressing questions. This week, we have some great news for business owners: the Paycheck Protection Program reform bill was signed into law. This means small business owners will gain more flexibility and time to use their PPP loan money. Read on for all the notable changes you need to know about the PPP reform bill and what it means for your loan forgiveness.

Forgiveness Period Has Been Extended

Originally, the PPP loan allowed for 8 weeks to use the allocated funds in order to receive forgiveness, this is now being extended to 24 weeks OR until the end of the year (12/31/2020), whichever is sooner.

New borrowers now have five years to repay the loan instead of two. Existing PPP loans can be extended up to 5 years if the lender and borrower agree. The interest rate will remain at 1%. The bill allows businesses that took a PPP loan to also delay payment of their payroll taxes, which was prohibited under the CARES Act.

Payroll Cost Requirement Has Been Reduced

The previous requirement of using 75% of the PPP loan towards payroll costs has now been reduced to 60%. This means that if you received a $100,000 loan, you now only have to use $60,000 towards payroll costs, freeing up more funds to allocate towards eligible non-payroll costs such as rent and utility payments.

One important note: Previously, payroll cost forgiveness was based on a sliding scale, it is now a cliff. Before, if you spent less than 75% of your loan on payroll costs, it would just reduce your eligible forgiveness amount. Now, if you spend less than 60% of your loan on payroll costs, none of the loan will be forgiven.

More Time to Restore Workforce

Once small business owners received the PPP loan, they had to use it to restore 90% of their workforce. This means that if you had 10 Full-time Equivalents (FTE), you had to hire back 9 of your employees back. Under the this reform bill, employers now have until the end of the year (12/31/2020) to restore their workforce to pre-pandemic levels.

Previous guidance excused employers from bringing back workers if they can document that they were unable to rehire. For example, if an employer extended a good faith offer to a previous employee and that employee rejected the offer to return, the employer could provide documentation that this exchange occurred and be excused from bringing back the worker. The exemptions under the new bill allow borrowers to adjust if they 1.) could not find qualified employees or 2.) were unable to restore business operations to pre-pandemic levels (employment levels before Feb. 15, 2020) due to COVID-19 related operating restrictions.

Share on social!

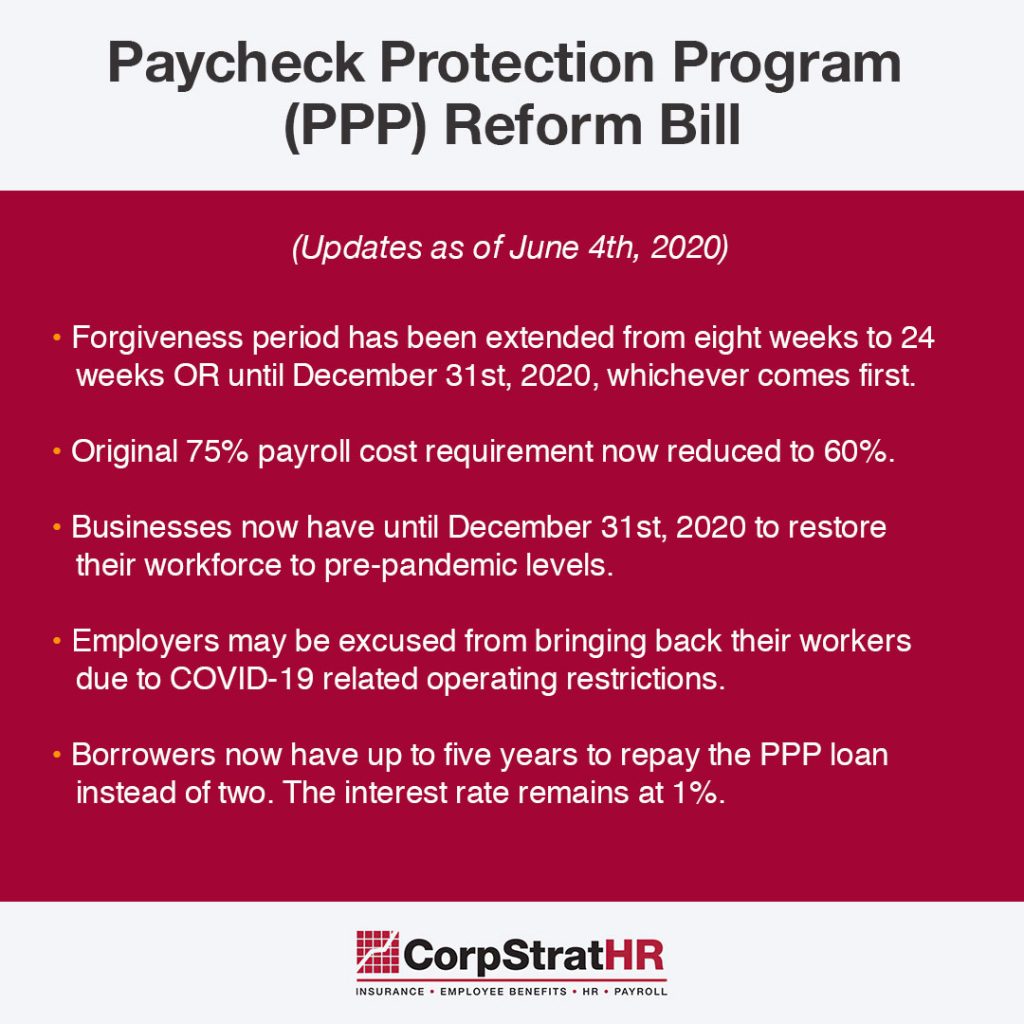

Our shareable graphic rounds-up all the notable changes to the PPP Loan. Feel free to share and tag us on Facebook, LinkedIn and Twitter.

—

We’ll keep you posted as more updates arise. If you have any additional questions, please email us at marketing@www.corpstrat.com.